You already knew that a travel medical insurance premium could vary from a few dollars to a few thousands of dollars, but many travellers ignore their travel medical insurance premium is tax deductible.

Get a tax credit for medical expenses

That’s right: the premium paid for your travel medical insurance is part of your medical expenses and can give you a tax credit. Travel insurance premiums of “non-medical” protections, such as trip cancellation and interruption insurance, or baggage insurance, are not tax deductible however.

Get your documents from the Tour+Med Client Portal

To calculate this in your medical expenses, you must have proper documentation. At Tour+Med, we stopped providing a document entitled “tax receipt” since it was an additional page in an already voluminous document, but mostly because all the necessary information can be found on page 1 of your Travel Insurance Confirmation.

What if your policy was modified after purchase?

By experience, we know a travel insurance policy can be modified many times, due to a change in your medication or to your trip dates, for example. The premium you finally paid could differ from the one presented on your Travel Insurance Confirmation. If that’s your case, you’re invited to use the Client Portal to download the receipt showing the official premium paid for your policy, after modifications.

How to get it:

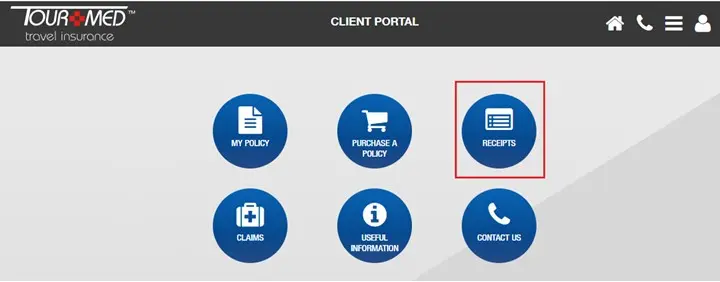

- Connect to the client portal.

- Click on RECEIPTS on the home page.

- Select the applicable policy number from the dropdown menu to see the receipt. You can download it or print it.

You may also get it this way:

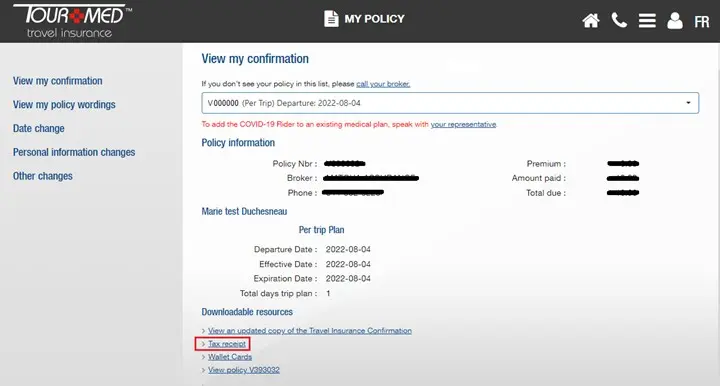

- Click on MY POLICY.

- Click on View my confirmation.

- Select the applicable travel medical insurance policy from the dropdown menu.

- Click on Tax receipt at the bottom of the page, beneath Downloadable ressources.

For any question, feel free to speak with your broker or to contact Customer Service.